By Chad Littell, CoStar Analytics

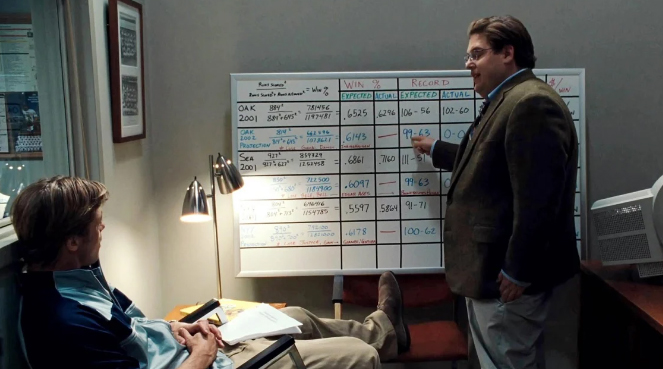

In the popular movie, “Moneyball,” the general manager of the Oakland Athletics Major League Baseball team played by Brad Pitt is faced with the challenge of competing against wealthy teams with his gutted roster and a restrictive budget. Given the realities of his situation, the manager is forced to ignore conventional wisdom and fires his head scout, telling him they must “adapt or die.”

Similarly, commercial real estate operators need to assess their exposure to the current stagflation conditions of higher interest rates and slowing income growth that have created one of the most challenging operating environments for real estate. Higher vacancies are likely to drive capitalization rates higher, exerting downward pressure on property values.

In the current environment, the conventional methods of valuing assets and securing financing no longer work. Industry stakeholders need to understand the impact of these dynamics and prepare for the ongoing challenges. A closer look at supply and demand helps to illuminate the uncertain path ahead.

The office sector presents a particularly stark illustration of these challenges. Up to 93 million square feet of office space is projected to be returned to the market this year. Through April 2024, a total of 24 million square feet has already been returned, significantly increasing vacancy rates beyond any level seen in the past. Next year is expected to be the second-worst year on record for office vacancy, trailing only 2024’s misery. Year-over-year income growth is already negative in the sector, a trend expected to continue for the rest of the year, and perhaps even longer.

Industrial property assets benefited from low vacancy at the start of 2023, but the sector now faces a flood of competing supply deliveries. The net change in occupancy, or net absorption, fell to just 15 million square feet over the first four months of this year, signaling that annual absorption totals for this year will likely fall far below initial estimates of 133 million square feet. Therefore, vacancy rates in this sector should peak higher than preliminary forecasts suggest, and take cap rates with them.

Retail waters are also becoming a little choppy, with a meager 5.1 million square feet of net absorption through April, suggesting the sector may realize only about half of the initially projected absorption for the year. The unique aspect of the retail market is that hardly any new projects are being built, which should help keep a lid on vacancy in the coming months.

It will be important to watch consumer spending in this sector. The bifurcation of high-end and low-end consumer spending will create winners and losers in retail as most of the liquidity and spending power are concentrated at the top.

Control What You Can

Commercial real estate operators should not count on lower interest rates to bail them out in the near future. Instead, they should focus on things they control as they adapt to this changing environment. As the noted economist John Maynard Keynes aptly stated, “Guessing at the future of interest is, in my opinion, one of the most puzzling problems in the world.”

Investors can exert control over certain aspects of their portfolio by focusing on preserving in-place income. Strategies such as building move-in-ready spec suites, signing early lease renewals, offering tenant concessions, holding broker open houses, differentiating the tenants’ property tour experience, and responding quickly to lease inquiries can help maintain occupancy and ensure steady income over the coming years.

From a seller’s perspective, considering selling the building to one of the property’s anchor tenants or a large corporate user in the market could create a viable exit strategy. Additionally, proactive steps can be taken to prepare a property for sale, including addressing deferred maintenance, touching up the landscaping and high-traffic common areas, organizing the property’s financial statements and operating history, obtaining third-party reports, and strategizing asset management objectives with trusted brokerage advisors.

Moreover, it’s important to remember that the commercial real estate industry has a history of cyclical ups and downs. Those who embrace the current uncertainties will find numerous opportunities to capitalize this year. The industry’s resilience suggests that a rebound is not a matter of if but when.